3 interesting pieces of data that show why you shouldn’t panic during market volatility

Over the last two years, investors have experienced a lot of investment and market volatility. If you’ve been tempted to change long-term plans as a result of this volatility, we have the data that highlights why you shouldn’t panic. Read on to find out why panicking and making knee-jerk changes should be avoided.

At the start of the Covid-19 pandemic, markets fell sharply, and investors continued to experience market volatility as the situation and restrictions changed. Just as things were slowly getting back to “normal”, tensions with Russia began to rise, and stock markets reacted strongly when Russia invaded Ukraine in February. It’s therefore been over two years of watching investments fall and rise in value.

Seeing the value of your investments fall can be nerve-racking. You may be tempted to make withdrawals or changes to your portfolio as a result.

However, while there are times when it may be appropriate to change your investments, any changes should reflect your personal circumstances. They absolutely shouldn’t be a knee-jerk reaction to periods of market volatility.

But we know that tuning out the noise and looking at long-term investment trends can be easier said than done. So, these three pieces of data can help you see why, in most cases, sticking to your investment strategy is the best option.

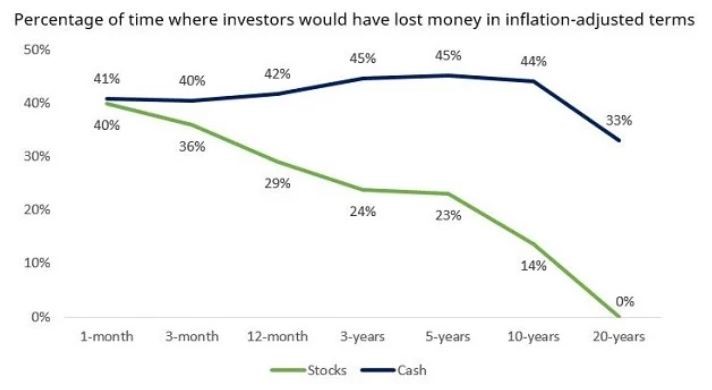

1. Stock market risk reduces the longer you invest

All investments carry some level of risk, and the value of your investments can fall.

However, over the long term, the ups and downs of investment markets can smooth out. This means that the longer you invest for, the less risk there is that you will lose money when you look at the long-term outcomes. This is why you should invest for a minimum of five years. It’s also why all our clients know that they are investing for the medium to long-term.

The below graph shows how the risk of losing money overall falls when you invest for a longer period. This compares to holding cash, which can lose value in real terms as the cost of living rises, which interest rates are unlikely to keep up with.

Source: Schroders

So, while you may think about withdrawing your money amid market volatility, leaving your money invested could reduce the risk of your portfolio falling in value.

Your investments should reflect your risk profile, which considers several factors, such as your goals and capacity for loss.

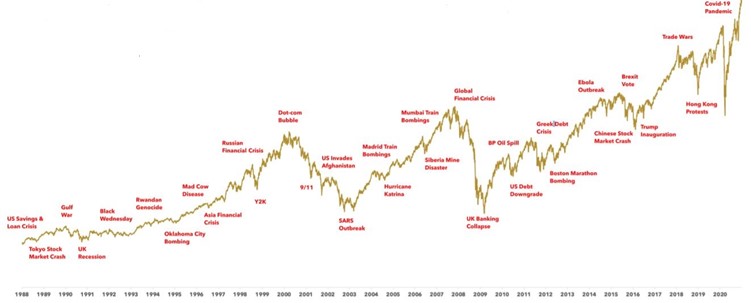

2. Markets have historically bounced back from market volatility

When you’re experiencing volatility, it can seem like a one-off event. Yet, if you look back over the years, you’ll see there are often events that can seem like reasons not to invest or to change your investment strategy.

In the last decade alone, there’s been the Brexit vote, Trump’s inauguration, trade wars, and protests in Hong Kong. All of these have caused some degree of market volatility.

During these periods, your investments may have fallen in value. Yet, if you review the long-term trend, markets have historically bounced back and gone on to deliver returns.

The graph below highlights how negative world events can cause stock markets to fall.

Source: Bloomberg, Humans Under Management. Returns are based on the MSCI World price index from 1988 and do not include dividends. For illustrative purposes only.

While there have been sharp falls, the general trend of stock markets has been upwards over the last 30 years.

Data from Schroders shows that stock market corrections, where there is a 10% drop, are not as rare as you might think either. The US market has fallen by at least 10% in 28 of the last 50 calendar years. Yet even with these dips, the market has returned 11% a year over the last 50 years on average.

3. Trying to time the market and avoid market volatility could cost you money

As stocks rise and fall, it can be tempting to try and time the market. This is where you buy stocks at a low price and sell them when the value is high. Of course, everyone wants to do that. But, in practice, it’s incredibly difficult to consistently predict how the markets will change.

Even if you miss out on just a handful of the best performing days of the market, you could lose out. The below table shows the returns from an investment of £1,000 between 1986 and 2021 based on leaving your money invested and missing some of the best days.

Source: Schroders

If you had invested in the FTSE 250, missing just the 30 best days over these 35 years would cost you almost £33,000.

The findings highlight why “it’s time in the market, not timing the market” is a common saying when investing. Staying the course and having faith in your long-term investment strategy makes sense for most investors.

Creating an investment strategy that’s right for you

The above graphs and table highlight why you shouldn’t panic when investment markets experience volatility.

That being said, it’s important to remember that investment performance cannot be guaranteed, and that past performance is not a reliable indicator of future performance.

Building an investment portfolio that reflects your goals and takes an appropriate amount of risk is crucial. Working with qualified, experienced financial planners can help you with this. If you’d like to talk about investing, whether you have concerns about market volatility or want to start a portfolio, please contact us.

Please note: This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.